Good deals rarely hit the open market

Most investors like the idea of owning a great SME - but not the reality of sourcing deals, running diligence, negotiating terms, or managing a team once the deal is done.

At Zenify, we work on active buy-side mandates for corporate acquirers, reviewing thousands of businesses to find the right one. Many we pass on are still strong - just not the right fit for that client. That creates a quiet opportunity: overlooked businesses with real fundamentals, invisible to most investors.

This service is for those who want to own well - without chasing deals, second-guessing numbers, or getting pulled into day-to-day operations.

You Invest. We Operate.

We structure the deal, handle the risk, and deliver the upside you get a front-row seat without being on the field.

Deal Sourcing Challenges

.png)

Deal Origination

We find off-market opportunities that fit your criteria.

Hidden Risk Exposure

.png)

Operational Turnaround

Our team joins the business to fix the risks and build value.

Valuation Uncertainty

.png)

Transparent Reporting

You receive consistent updates without ever needing to get involved.

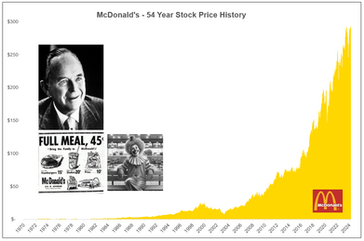

Own A Fast-Growing SME - Without The Daily Grind!

A done-for-you investing service for time-poor investors who want SME exposure without managing people, payroll, or headaches.

Why Investors Trust Zenify

"Built For Investors Who Value Discipline Over Deal Spam"

Zenify isn’t a marketplace. We don’t list deals, and we don’t act as a broker. Every opportunity we share comes from live, hands-on M&A work - businesses we’ve already reviewed for serious acquirers.

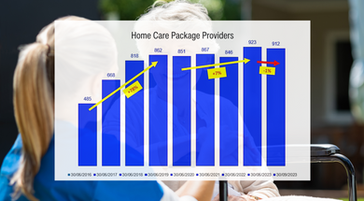

Each year, we assess over 1,000 Australian SMEs through active mandates. Only 1–2% make the shortlist. The rest are quietly overlooked - not because they’re weak, but because they weren’t the right fit for that client.

Investors trust Zenify because our deal flow is earned, not scraped. We bring a buyer’s lens, not a seller’s pitch - and we only share opportunities we’d back ourselves.

.png)

_edited.jpg)